The most up-to-date information on the VITA program will be communicated on this page. This page was last updated on January 11, 2024.

The UMD Volunteer Income Tax Assistance (VITA) program provides tax return preparation services for low and moderate-income residents of the Duluth-Superior area. Please note the IRS determined income limit for eligibility will be strictly enforced.

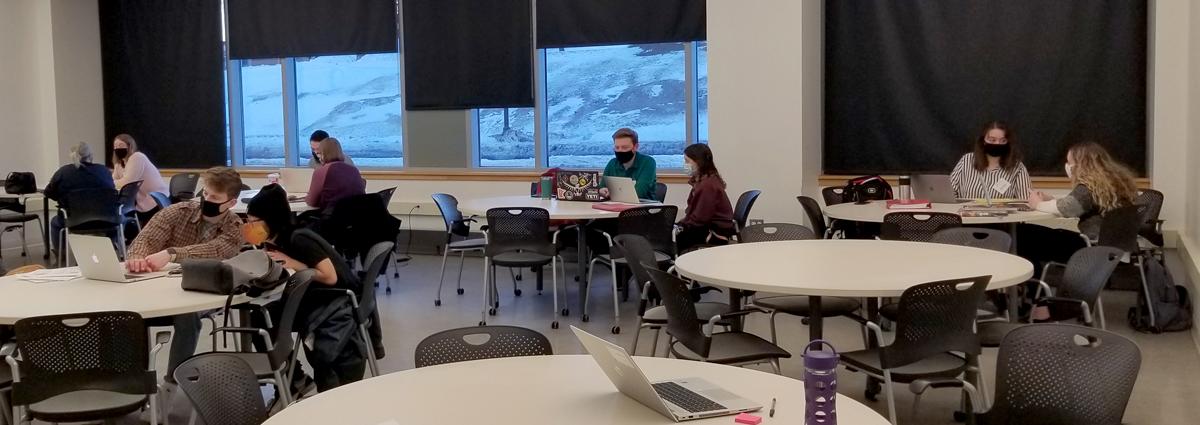

Students participating in the VITA program will earn one or two credits in their major, gain real-world experience in tax return preparation, and participate in a service-learning program at two community locations, the Duluth Public Library and in LSBE.

As a service-learning program, VITA provides a hands-on experience not only preparing the returns for clients but also developing client service skills and aiding people in need in their community. Students gain both marketable workplace skills as well as the benefits that come from giving back to their community.

FREE VOLUNTEER TAX ASSISTANCE

For more information and to schedule an appointment call 218-726-6779

Our email (not for appointment scheduling) is [email protected]

Office hours

The VITA office will be open and receiving calls from January 22, 2024 until April 19, 2024 during the following times:

Mondays 10 AM - 12 PM

Tuesdays 11 AM - 1 PM

Wednesday 10 AM - 12 PM

Thursdays 11 AM - 1 PM

UMD Campus- Labovitz School of Business and Economics

Location: 1318 Kirby Drive, LSBE Rooms LSBE 134 and 144

UMD Map

UMD Visitor Parking Information

UMD Campus Parking Map

Duluth Public Library

Location: 520 W. Superior St.

IRS VITA return preparation sites are operated by certified volunteers. Site operation hours and services offered may be limited. Please be advised that you may not be immediately served. Your patience and understanding are appreciated.

VITA 2023 Tax Season (Feb 3, 2024 - March 30, 2024)

TAX PREPARATION SERVICES ARE AVAILABLE BY APPOINTMENT ONLY.

NO WALK INS ARE PERMITTED.

* Appointments must be scheduled with our volunteers during office hours. No appointment requests will be honored if left via voicemail or via email. We will return calls in the order they were received.

Appointments will be available for the following days, times and locations:

- Monday, 1-4 p.m., Duluth Public Library

- Wednesday, 3-7 p.m., UMD

- Saturday, 10:30 a.m. - 2:30 p.m., Duluth Public Library

Required Items to file your taxes:

- Government issued photo identification

- For married filing jointly, both spouses must be present

- All forms, W-2 and 1099

- Information for other income

- Information for all deductions/credits including any forms 1098

- A copy of last year’s return

- Account number and routing number for direct deposit of refund

- Social Security cards or Individual Taxpayer Identification notices/cards for you, your spouse, and/or dependents

- Total paid, if any, to daycare provider and their tax ID number

- Birthdays for you, spouse, and dependents on the return

- Forms 1095-A (Affordable Health Care Statements)

- Rent Certificates (From CRP) and/or 2024 property tax statement (for 2023 refunds)

- Receipts for purchase of school-related materials for K-12 students

The IRS provides guidelines that the VITA Program must follow. Tax Return preparation is:

- Restricted to taxpayers with low to moderate-income ($62,000 or less).

- Limited to returns with the following types of income:

- Wages and salaries (Form W-2)

- Interest Income (Form 1099-INT)

- Dividends Received (Form 1099-DIV)

- State Tax Refunds (Form 1099-G)

- Unemployment Compensation (Form 1099-G)

- IRA Distributions (Form 1099-R)

- Pension Income (Form 1099-R, Form RRB-1099)

- Social Security Benefits (Form SSA-1099)

- Simple Capital Gain/Loss

- Sale of Home (1099-S) Limited to basic situation

- Gambling Winnings (Form W-2G)

- Cancellation of Debt from Credit Cards (1099-C)

- Limited to returns with basic deductions

- Limited to returns with the following tax credits:

- Education Credits (Form 1098-T)

- Child Tax Credit

- Earned Income Credit

- Child & Dependent Care Credit

- Retirement Savings contribution credit

- Available for Affordable Care Act Statements (Form 1095-A)

Thank you for your patience and look forward to serving our community this upcoming tax season.